How Summitpath Llp can Save You Time, Stress, and Money.

How Summitpath Llp can Save You Time, Stress, and Money.

Blog Article

9 Simple Techniques For Summitpath Llp

Table of ContentsGetting My Summitpath Llp To WorkLittle Known Facts About Summitpath Llp.Summitpath Llp Can Be Fun For AnyoneThe 2-Minute Rule for Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Discussing

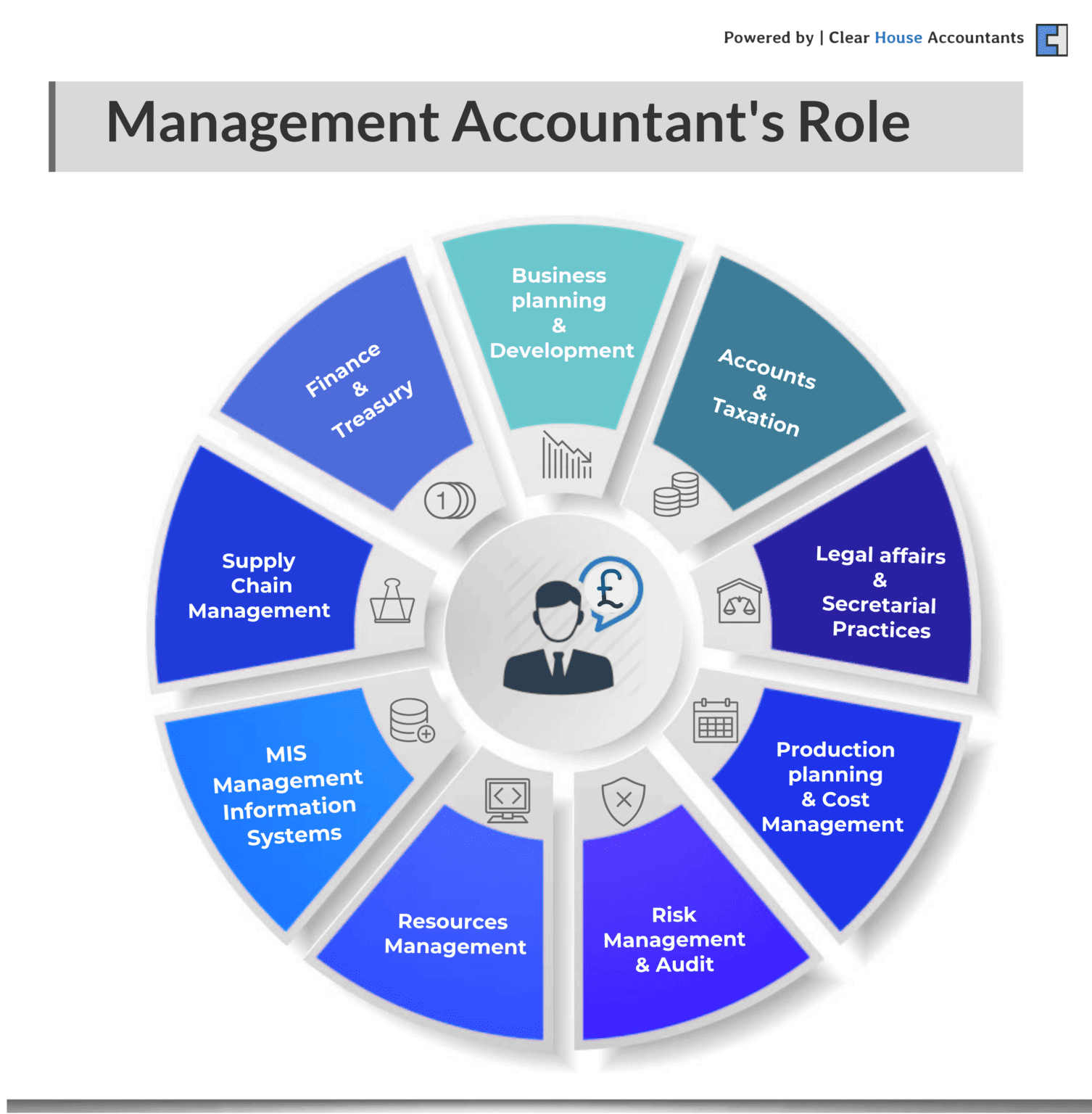

An administration accountant is a key role within a service, yet what is the function and what are they expected to do in it? ICAEW dives much deeper in this monitoring accounting professional guide. https://telegra.ph/Navigating-the-Financial-Frontier-Why-a-Calgary-Accountant-is-Your-Secret-Weapon-06-29. An administration accountant is an important role in any organisation. Working in the accountancy or money department, management accountants are responsible for the preparation of management accounts and several other records whilst also overseeing general accounting procedures and practices within the business.Putting together techniques that will certainly decrease organization costs. Getting finance for jobs. Advising on the financial effects of company decisions. Creating and managing monetary systems and procedures and identifying possibilities to enhance these. Controlling income and expenditure within business and making sure that expense is inline with spending plans. Overseeing accounting professionals and support with generic book-keeping tasks.

Analysing and managing threat within business. Administration accounting professionals play a highly crucial role within an organisation. Trick monetary information and records generated by monitoring accounting professionals are made use of by senior administration to make informed business choices. The analysis of company performance is a vital role in an administration accounting professional's job, this evaluation is created by looking at present monetary info and likewise non - economic data to determine the setting of business.

Any company organisation with an economic division will need an administration accounting professional, they are also regularly utilized by monetary institutions. With experience, a management accountant can anticipate solid career progression.

Not known Facts About Summitpath Llp

Can see, evaluate and recommend on alternative sources of organization money and different means of raising money. Communicates and suggests what impact economic decision production is having on growths in regulation, values and governance. Assesses and advises on the appropriate techniques to take care of organization and organisational efficiency in relation to organization and finance danger while communicating the effect effectively.

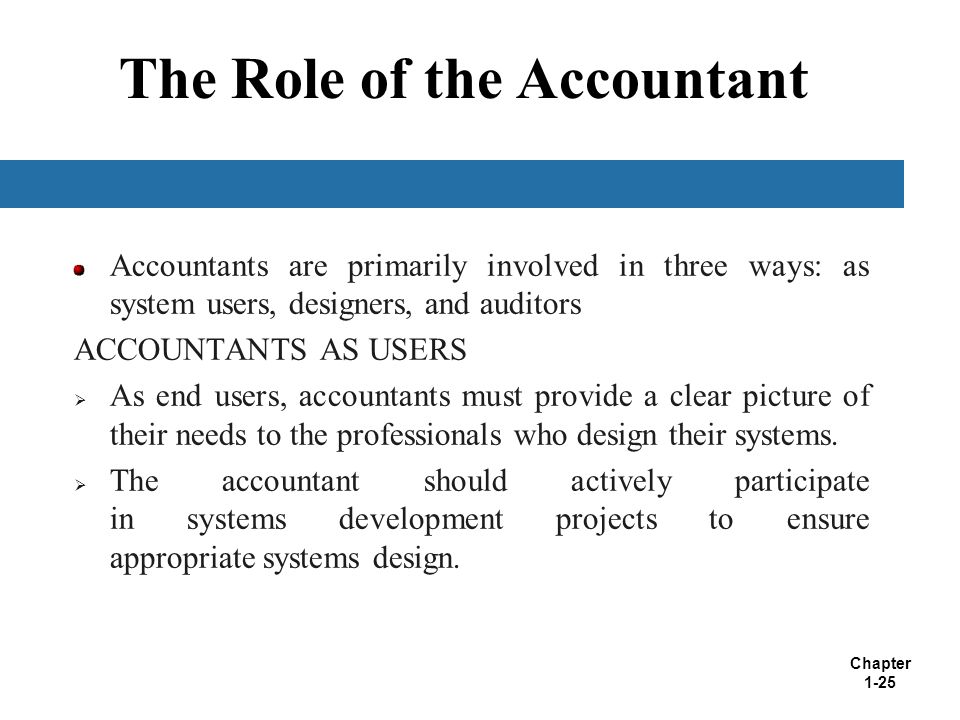

Uses different innovative methods to implement technique and manage adjustment - Calgary Bookkeeping firm. The distinction in between both monetary accountancy and managerial audit worries the desired individuals of details. Supervisory accountants call for company acumen check it out and their purpose is to work as business companions, assisting company leaders to make better-informed decisions, while financial accountants intend to create financial documents to provide to exterior events

A Biased View of Summitpath Llp

An understanding of service is additionally important for monitoring accounting professionals, along with the capability to interact successfully whatsoever levels to suggest and liaise with elderly members of personnel. The obligations of a monitoring accounting professional need to be accomplished with a high level of organisational and calculated thinking skills. The average wage for a legal monitoring accounting professional in the UK is 51,229, a rise from a 40,000 average made by monitoring accountants without a chartership.

Giving mentorship and management to junior accountants, cultivating a society of collaboration, growth, and operational quality. Working together with cross-functional groups to establish budgets, projections, and long-lasting economic approaches. Remaining notified about adjustments in accountancy policies and ideal techniques, applying updates to internal processes and documents. Must-have: Bachelor's level in accountancy, finance, or an associated area (master's chosen). Certified public accountant or CMA certification.

Flexible work options, including hybrid and remote timetables. To use, please send your resume and a cover letter detailing your credentials and rate of interest in the senior accountant function (https://issuu.com/summitp4th).

A Biased View of Summitpath Llp

We're anxious to discover an experienced senior accounting professional ready to add to our business's financial success. HR call info] Craft each section of your work description to show your company's special needs, whether working with an elderly accounting professional, company accountant, or an additional professional.

A solid accounting professional work account surpasses detailing dutiesit clearly connects the certifications and assumptions that align with your organization's demands. Separate in between essential certifications and nice-to-have abilities to aid candidates determine their viability for the placement. Define any type of qualifications that are required, such as a CPA (State-licensed Accountant) permit or CMA (Certified Administration Accounting professional) classification.

Some Ideas on Summitpath Llp You Need To Know

Adhere to these finest practices to produce a job description that reverberates with the right prospects and highlights the one-of-a-kind elements of the function. Bookkeeping roles can differ extensively depending on seniority and specialization. Avoid obscurity by laying out particular tasks and areas of focus. "prepare month-to-month financial declarations and oversee tax obligation filings" is far more clear than "handle financial documents."Reference vital locations, such as monetary reporting, bookkeeping, or payroll administration, to draw in prospects whose abilities match your requirements.

Accountants aid organizations make critical financial choices and corrections. Accounting professionals can be responsible for tax obligation coverage and filing, resolving equilibrium sheets, helping with department and business budgets, monetary projecting, communicating findings with stakeholders, and a lot more.

Report this page